🏥 Discover the Benefits of German Private Insurance for Expats

“Private or Public?” — usually this is the first question you’re asked when calling a doctor’s office in Germany.

If you want better service for a fair premium, let’s dive into the world of German private insurance and how German Sherpa helps you find the right coverage.

Private health insurance in Germany – known as Private Krankenversicherung (PKV) – is often the preferred option for high-income professionals, self-employed individuals, and expats. With faster access to care, more flexibility, and higher quality service, German private insurance offers real advantages over the public system.

At German Sherpa, we guide expats through Germany’s complex insurance landscape. We compare top private health insurance providers, explain your options clearly, and help you find the best plan tailored to your needs — with no bias and in your preferred language.

✅ Why Choose German Private Insurance?

- Premium medical care: Access to top-tier doctors, specialists, and private clinics.

- Flexible coverage: Choose the benefits you want — from dental and vision to alternative treatments and premium hospital stays.

- Fast appointments: Private patients often avoid long waiting times.

- Custom care: Many private policies offer global coverage, useful for frequent travelers.

- Cost-effective for professionals: Especially for younger, healthy individuals with higher income, private insurance can be cheaper long term than public coverage.

👤 Who Can Apply for German Private Insurance?

You may be eligible for German private insurance if you fall into one of the following categories:

- You earn more than €73,800 per year (2025 threshold)

- You are self-employed or a freelancer

- You are a Beamter (civil servant)

- You are a student over 30 or beyond the 14th semester

We’ll help you assess your eligibility, understand the pros and cons, and make a confident decision based on your financial goals and lifestyle.

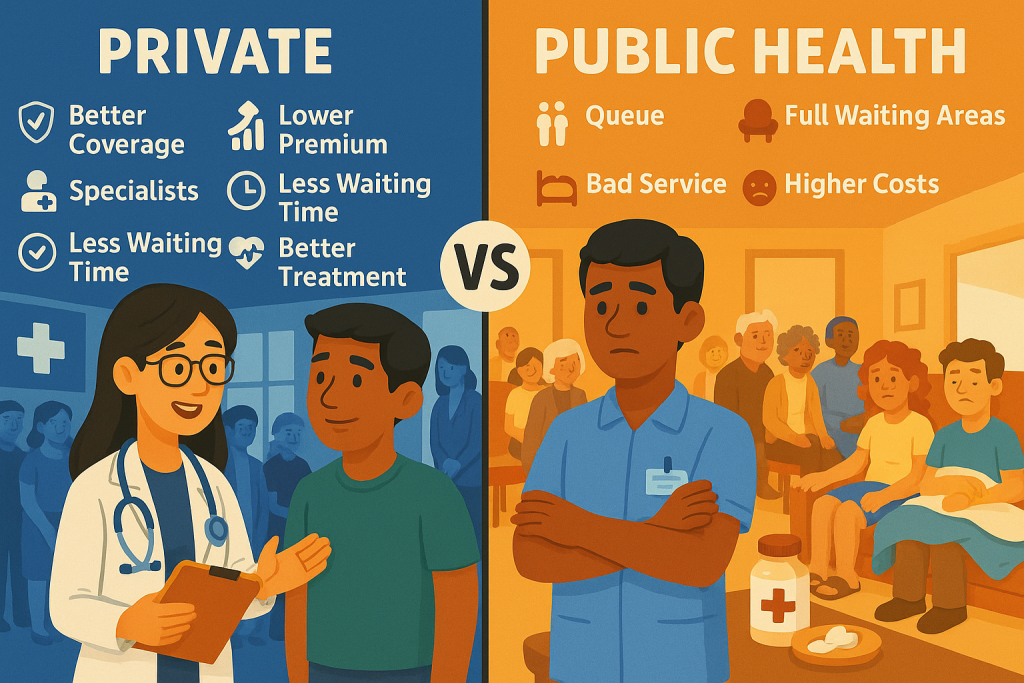

🏛️ Public vs. Private: What’s Better for You?

Public insurance in Germany is based on income and includes family members for free. But it comes with limitations — standard services, longer wait times, and no flexibility to customize. In contrast, German private insurance is tailored to your needs and gives you more control, but requires individual contracts and risk assessments. We provide an honest comparison so you can make the best choice.

🌍 Tailored Support for Expats

Navigating German private insurance as an expat can be overwhelming. Tariffs, language barriers, and paperwork often discourage people from making the switch. That’s why our advisors work in English and other languages to offer 1:1 personal consultations — online or in person. We explain everything clearly and support you step by step.

Whether you’re new in Germany or planning to switch from public to private insurance, we’ll help you find the most suitable and affordable coverage.

📞 Book Your Free Consultation Today

Take control of your health and finances. Schedule a free consultation with a certified German Sherpa advisor and find out whether German private insurance is right for you.

When Private Health Insurance Is Not an Option

There may be situations where private health insurance in Germany is not available or advisable — for example, due to your current health condition, past medical history, family situation, or because your income is below the required threshold.

But even if private insurance isn’t the right fit, you still have great options.

We help you choose the best statutory (public) health insurance provider and enhance it with targeted supplementary insurance. This allows you to upgrade your coverage — such as better dental care, access to private hospital rooms, or treatment by senior physicians.

With the right add-ons, you can enjoy many of the benefits of private insurance — even while staying in the public system.