Disability Insurance (Income Protection)

Income protection insurance (Berufsunfähigkeitsversicherung or BU) is a vital safety net, providing financial security if you are unable to work due to illness or injury. Key features include:

- Monthly Income Replacement: Guarantees a regular monthly payout if you become unable to work in your current profession, ensuring you can cover living expenses and maintain your financial stability.

- Coverage for Various Causes: Protects against loss of income due to both physical and mental health conditions, including chronic illnesses, injuries, or burnout.

- Flexible Policy Options: Tailor the policy to suit your needs, with options to adjust the payout amount, waiting period, and additional benefits like coverage for rehabilitation or occupational retraining.

- Tax Benefits: Premiums for income protection insurance can often be deducted from your taxable income, reducing your overall tax burden.

- Independence from State Support: Provides a reliable source of income that is not tied to state disability pensions, which are often insufficient for maintaining your lifestyle.

- Lifetime Protection: Coverage can extend up to retirement age, ensuring long-term security regardless of when a disability might occur.

Why is Disability Insurance in Germany Important?

Income protection is essential for anyone whose financial well-being depends on their ability to work. Whether you are employed, self-employed, or a freelancer, your income supports your lifestyle, family, and future goals. Without BU insurance, an unexpected illness or injury could lead to significant financial strain and the loss of long-term savings.

This insurance is particularly critical for:

- Professionals with high-income careers.

- Individuals in physically or mentally demanding jobs.

- Freelancers and self-employed individuals who lack employer-provided safety nets.

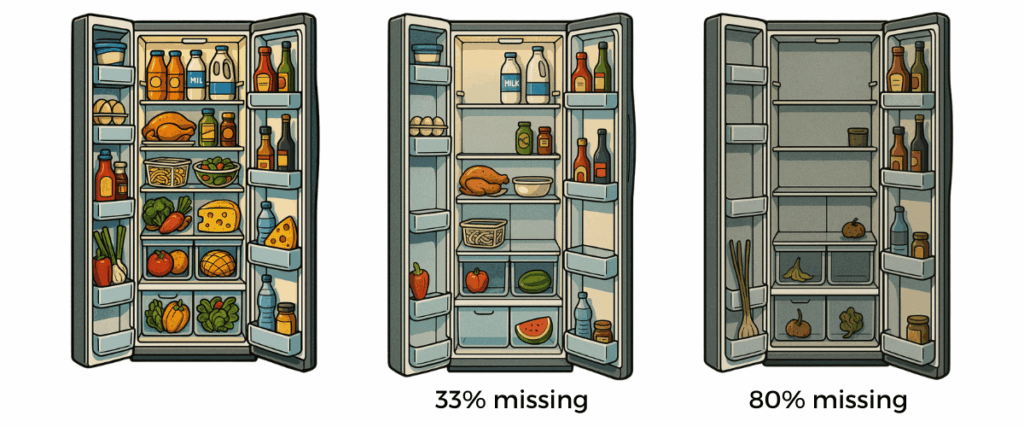

🛑 What Happens When 33% or Even 80% of Your Income Disappears?

Imagine your fridge looked like your bank account after a serious illness or accident.

If you lose your ability to work in Germany, here’s what really happens:

✅ First 6 weeks: Full salary from your employer

🩺 After that (up to 72 weeks): Statutory health insurance pays “Krankengeld” – max. 67% of your net income, capped and taxable

⏳ After 72 weeks: You may qualify for a public disability pension (Erwerbsminderungsrente)

→ But in over 80% of cases, only partial disability pension is granted, which means:

❗Only around €400–500 per month, regardless of your previous salary

So, what’s missing?

- 🍽️ Enough to cover food and basic living expenses

- 🧒 Protection for your children and partner

- 🏠 Security to pay rent or mortgage

- 💳 Contributions to your retirement

- 🧘♀️ Stability and peace of mind

Even with a legal employment contract and full public coverage, your income may drop by 67% or more – and for self-employed expats, there’s usually no coverage at all.

✅ Protect Your Income with German Sherpa

We guide you to the right income protection or disability insurance (BU) solution for your life in Germany – independent, fully explained, and tailored to your goals.

📞 Book your free 1:1 consultation today

👉 Don’t wait until it’s too late to protect your income – and your lifestyle.

Top Tip:

Make sure your policy defines “inability to work” (Berufsunfähigkeit) based on your current profession. This ensures you are protected even if you can perform other, less demanding work.

✓ Starts at around 70 Euro monthly premium (Depending on start age, porfession and current health status)

✓ min. 3.000 Euro monthly disability pension (Depending on your Income)

✓ coverage until 65 or 67 (ideal)

✓ support in English

Can be combined with Tax Saving Scheme to reduce taxes

At German Sherpa, we help you find income protection policies that are transparent, flexible, and tailored to your career and lifestyle. Don’t leave your financial future to chance—secure it today!

Clarity Starts With Structure.

We advise expats who live and work in Germany.