⚠️ The Hidden Pension Disaster in Germany: Rahul’s Story and What Every Expat Should Know

Rahul, a 40-year-old IT manager from India, has lived in Germany for 10 years. He earns a gross salary of €150,000 per year, owns a home in Munich, and has a young family. He plans to stay in Germany permanently.

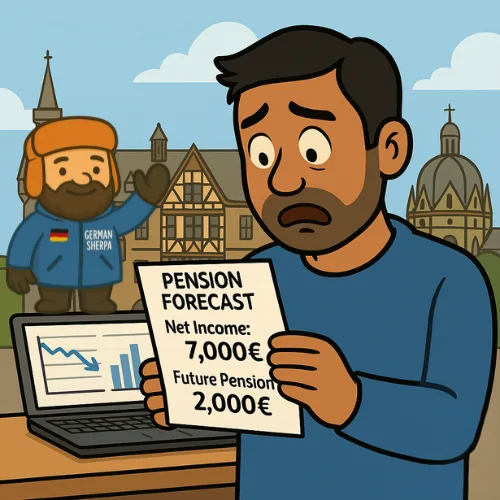

Everything seemed secure until he checked his pension forecast.

From €7,000 net per month today to just €2,000 in retirement?

That’s not just a gap — that’s a pension disaster. And it gets worse once you factor in inflation.

Rahul’s Pension Forecast – Step by Step

Rahul contributes the maximum possible to Deutsche Rentenversicherung. With 37 total working years in Germany by the time he retires at age 67, he’ll earn around 74 pension points.

With a pension value of €39.32 per point (2025 West level), this gives him around €2,910 gross per month — which equals about €2,000 net after taxes and health insurance.

But what will that be worth in 27 years?

Assuming 2.5% annual inflation, €2,000 in 2052 will have the purchasing power of just around €1,190 today.

So Rahul is facing a real income drop of over €5,800 per month — a loss of more than 80% of his current standard of living. And this is based on optimistic assumptions.

This is the core of the pension disaster many high-earning expats in Germany are unknowingly walking into.

Why Expats Are Especially at Risk

Expats often assume: I earn well, I contribute monthly, I’ll be fine.

But the German state pension system was never designed to replace high salaries. It covers basic living expenses — not travel, not family support, not comfort.

The problem worsens when inflation, rising rents, and healthcare costs in retirement are ignored.

Some consider investing back home — for Rahul, that’s India — but this comes with high currency risk. The Indian Rupee has already weakened to nearly ₹100 per €1. Over decades, this kind of depreciation and domestic inflation erodes both capital and income.

That’s why we do not recommend Indian-based investment for retirement — unless it’s managed from Germany, in EUR or USD, and part of a broader international portfolio. The control, tax treatment, and protection are simply better here.

How to Avoid a Pension Disaster — While Living in Germany

At German Sherpa, we support expats like Rahul with clear, tax-efficient, Euro-based solutions that protect their long-term purchasing power.

Here’s what a solid strategy looks like:

Rürup Pension (Basisrente)

Perfect for high earners, this private pension allows tax-deductible contributions and offers guaranteed lifetime annuities — with flexible investment choices in EUR.

ETF & Global Investment Portfolios

We help build long-term investment strategies in EUR or USD, diversified globally, but tax-optimized for German residents. International exposure — without currency chaos.

German Real Estate

Whether it’s a self-used home or a rental investment, real estate provides protection against rising rents and serves as a hedge against inflation.

Employer Pension Schemes (bAV)

Many employers offer attractive corporate pension plans — yet many expats never activate them. We show you how to leverage these without giving up flexibility.

Cross-Border Diversification — Managed from Germany

For those who want some exposure to Indian assets (e.g. to support family), it’s possible — as long as it’s part of a professional EUR/USD-based investment strategy run from Germany. This avoids INR losses and tax/reporting headaches.

What About You?

Have you calculated what your pension will really provide?

Have you factored in 25+ years of inflation?

Do you have a clear strategy to avoid your own pension disaster?

Most people don’t. But once you see the numbers — like Rahul did — it’s impossible to ignore them.

Book Your Free Consultation

Let’s take a look at your numbers together and give you clarity. We speak English. We understand expats. And we’ve been helping people like Rahul since 2015.

👉 Strategy Meeting with Marcel

Quick Recap

- Rahul earns €150K gross today

- He contributes the maximum to public pension

- He expects €2,000/month net — worth only ~€1,190 after inflation

- His real income drop: ~€5,800/month

- He avoids investments in INR and focuses on EUR/USD-based strategies from Germany

- A mix of private pensions, ETFs, real estate, and bAV can close the gap

Don’t let a pension disaster catch you by surprise.

Clarity Starts With Structure.

We advise expats who live and work in Germany.